Crypto

Arbitrage

Bot GEN 2.0

Next-Generation Fully Automated A.I. Crypto Arbitrage Trading Robot & Ecosystem

- NUMBERS

Statistics

- Target ROI

Up to 30%

- Up to 30% monthly return depending on gas conditions, market volatility, and available liquidity across DEXs.

- Execution Throughput

Up to 300

- Supports up to 300 requests per second (RPS) via integrated DEX aggregators and node providers — enabling real-time scanning and execution on Ethereum.

- Capital Allocation

$100 Million BTC/USDC

- Up to $100 million in deployable capital (BTC/USDC equivalent), dynamically optimized per opportunity to maximize risk-adjusted ROI.

- Minimum Trade Profit

Min $1 USD

- Each executed trade is designed to generate at least $1 USD in net profit, factoring in slippage, gas, and MEV protection — all enforced on-chain.

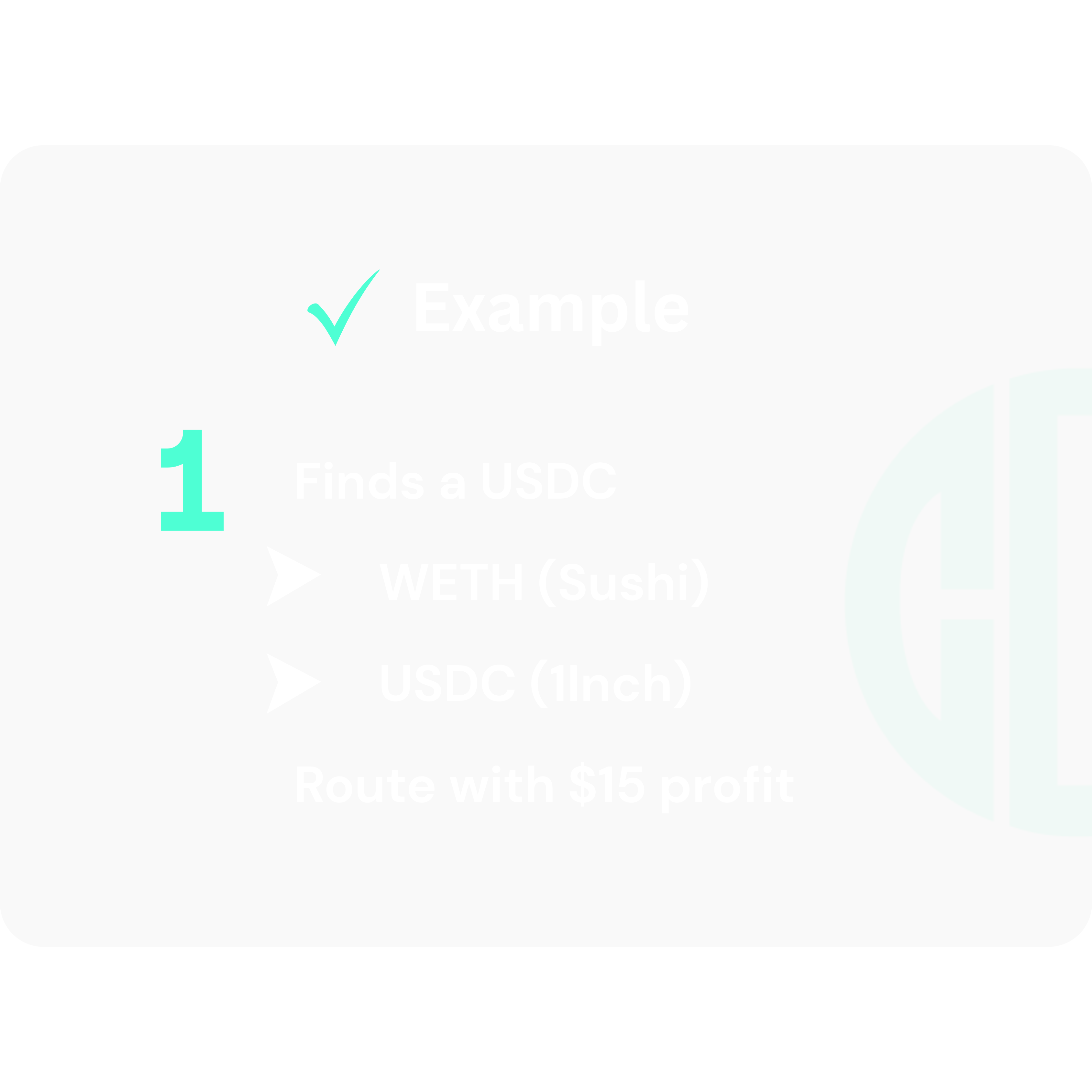

- PRODUCT

Modular Architecture

- CAB GEN 2 - Redis Core

Scanner

- Constantly monitors DEXs and aggregators for arbitrage opportunities.

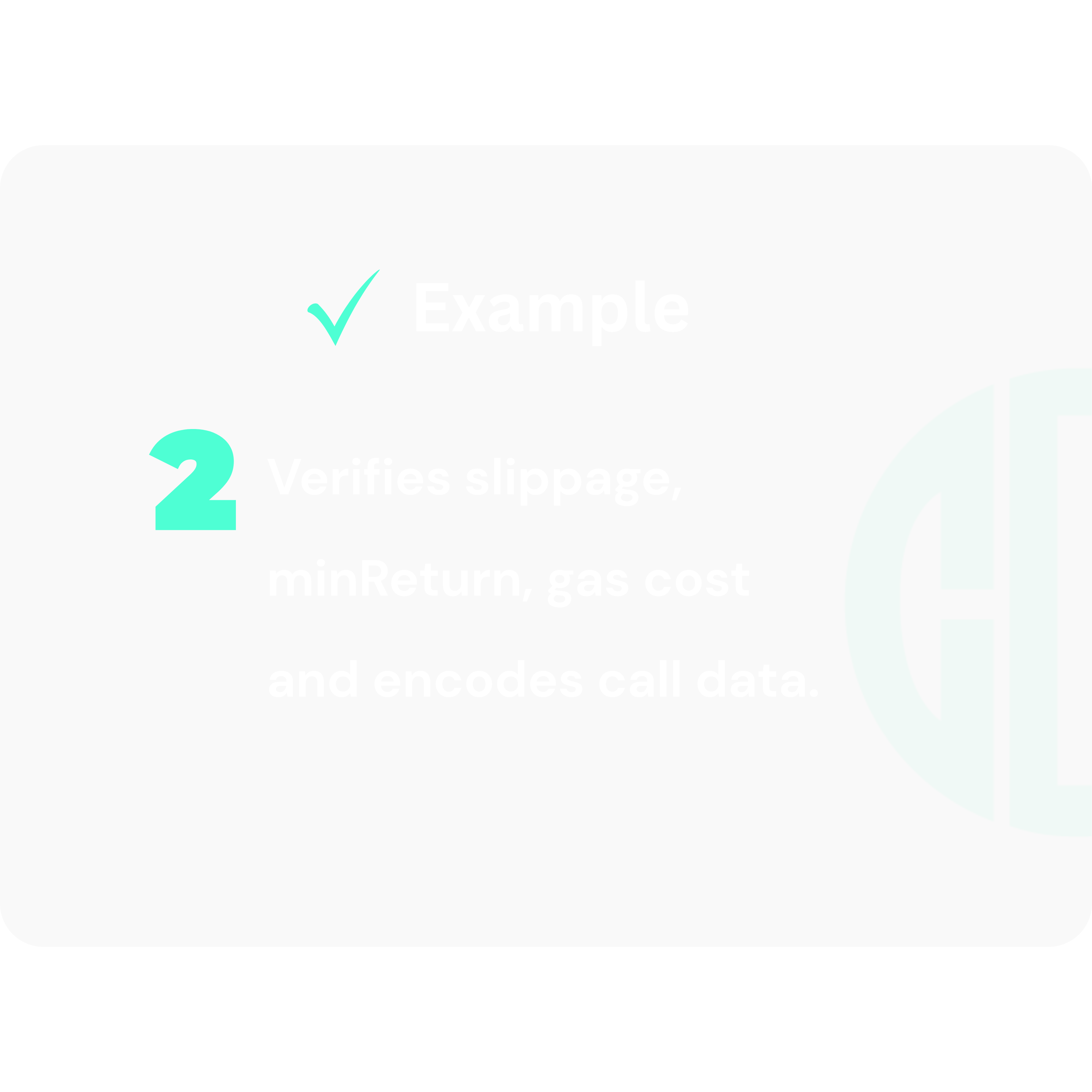

- CAB GEN 2 - Redis Core

Builder

- Validates opportunities and prepares call-data and gas strategies.

- CAB GEN 2 - Redis Core

Executor

- Executes trades via Flashbots or with safety checks.

- CAB GEN 2 - Redis Core

Pro Gas Manager

- Calculates optimal gas fees using multiple oracles.

- ARBITRAGE

What is Arbitrage?

Arbitrage is a trading strategy that exploits price discrepancies across decentralized exchanges (DEXs) by simultaneously buying and selling the same asset in different markets — capturing small but consistent profits.

How it works on Ethereum:

- We scan hundreds of trading pairs across major DEXs like Uniswap, SushiSwap, and aggregators like 1inch, ParaSwap, 0x, and OpenOcean.

- When a price difference is detected, our smart contract executes a buy and sell within the same block.

- Profits are captured instantly — often within milliseconds — with zero market exposure.

Is arbitrage risk-free?

- In theory, yes. In practice, no.

Slippage, gas volatility, failed transactions, and MEV competition can introduce risk.

That’s why we built a professional-grade system:

- Ultra-fast scanners identify profitable opportunities in real time.

- Flashbots integration allows private, front-run-proof execution.

- Advanced smart contracts perform atomic transactions that only execute if the trade is profitable.

- Full round-trip routing ensures we return to USDC, minimizing residual risk.

We don’t just run a bot — we operate a precision-engineered Ethereum arbitrage system built for performance, consistency, and scalability.

- Competitive Advantage # 1

Artificial Intelligence

-

Next-Gen AI-Powered Infrastructure CAB GEN 2 is fully driven by enterprise-grade artificial intelligence, enabling real-time decision making, adaptive trade logic, and autonomous code optimization. Our system leverages cutting-edge AI models to stay ahead of the market. AI Systems Used:

* ChatGPT Pro

* CodeGPT

* Claude Sonnet 4 UltraMax

* Grok Pro

- Competitive Advantage # 2

Robust APIs

-

High-Performance API Layer CAB GEN 2 integrates with a robust ecosystem of DEX aggregators and infrastructure providers to deliver unmatched execution speed, data integrity, and scalability. Our system supports up to 300 requests per second (RPS), ensuring no opportunity is missed.

* 1inch

* Kyber NetworkK

* OpenOcean

* Paraswap

* Sushiswap

* Uniswap

* 0X

- Competitive Advantage # 3

Smart Contract

-

Our smart contract is a robust, production-grade Ethereum smart contract tailored for executing high-frequency arbitrage strategies securely. It integrates automated token approvals, USDC round-trip validation, multi-signature protection for fund withdrawals, and live trading constraints to ensure safe execution via bots (Flashbots compatible).

* Ownership & Access Contro

* Token & Router Whitelisting

* Arbitrage Execution

* Safety & Controls

* Profit Threshold & Stats

* Multi-Sig Security

- Sustainability

Intelligent Risk Controls

Risk mitigation is embedded in every layer of the CAB GEN 2 architecture, from trade validation to execution safety nets.

Execution

- TIERS

SaaS Licenses

Your SaaS license will automatically be upgraded to the next tier once you exceed the maximum trading balance. All associated fees will be automatically debited from your account.

Onboarding

- Invite Only Registration

Click on the Registration Link provided by the person that introduced you. Enter your details in the space provided in the online form and begin the onboarding process.

1

- User Verification

Verification is done by sumsub.com for KYC/ KYB and compliance. At this time, clients from the United States are not supported.

2

- Pick Your SaaS License

Select your SaaS license membership plan by exploring the available license options above.

3

- Terms & Conditions

All T & C’s must be reviewed and accepted by each client, thereby confirming acceptance of the Software as a Service (SaaS) licensing membership plan terms.

4

- Start Trading!

Start earning passive daily compounded residual rewards. Ability to withdraw both your trading rewards and principal trading funds during the first week of each calendar month.

6

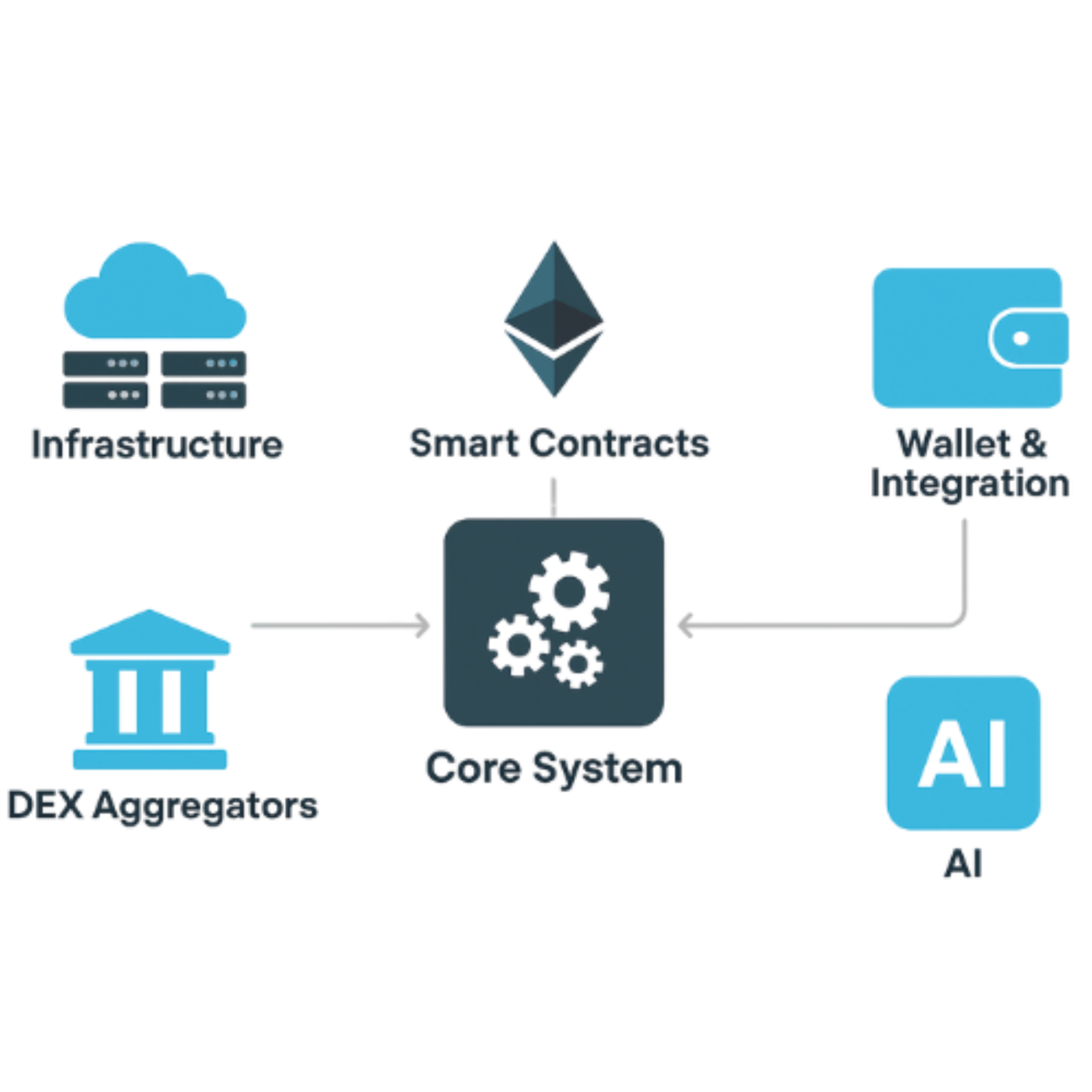

Infrastructure & Intergration

Infrastructure & Integrations CAB GEN 2 relies on a sophisticated stack of infrastructure and service providers to ensure reliability, execution integrity.

Contact Us

For more information, please contact us.

Contact Us

- We offer an extensive range of professional services and a high degree of specialization. We serve both retail & commercial sectors and bring over 20+ years of combined experience.

- CR, Costa Rica: Centro Comercial Plaza Boulevard Local 18, Jaco, Puntarenas, Costa Rica, 61101.

- Company Name: Coyle Capital Trust S.A. Registration Number: 3-101-794848

-

Sales@coylecapital.co

Support@coylecapital.co

Trading@coylecapital.co

Disclaimer

-

• Our company operates in accordance with Costa Rica's laws and regulations, including Ley de Derechos de Autor y Derechos Conexos, Ley de Patentes, Modelos de Utilidad, Diseños Industriales y Topografías de Circuitos Integrados, and Ley de Protección de Datos Personales.

• We adhere to international standards and guidelines set forth by organizations such as WIPO and respect intellectual property rights. - • We hold no liability for outstanding payments or monetary obligations owed by third-party suppliers to our clients.

- • We refrain from actively soliciting clients residing in any sanctioned countries.

- • We hold no liability for outstanding payments or monetary obligations owed by third-party suppliers to our company and clients.

- • We do not provide licensed and/or regulated financial advice of any kind.

- • Participation in our Crypto Arbitrage Bot program carries inherent risks, with the potential for complete loss of capital.

- • All forms of trading, including Arbitrage, Risk CFDs, and Margin FX, represent leveraged products entailing significant risks to capital.

- • Trading activities are not universally suitable and may result in the depletion of capital. We advise depositing only funds deemed expendable.

- • Before engaging in trading activities, it is imperative to comprehensively understand associated risks, while aligning with your financial objectives and level of experience.

- • We hold no liability for outstanding payments or monetary obligations owed by third-party suppliers to our clients.

- • It is crucial to understand that trading profits are not guaranteed.

- • Prospective participants should seek independent professional advice before lending.

- © Coyle Capital. 2025